High Earner Allowances

Death in service benefits for high earners can breach pension allowances.

Relevant Life Cover.

Case Study.

Death in service benefits are an attractive part of a remuneration package, but for high earners they could risk breaching their lifetime pension allowance and reducing their maximum pension contribution. The Relevant Life Plan could provide a solution: it doesn’t count towards these allowances and is also tax-deductible for the company as a business expense.

The maximum amount of cover depends on age and remuneration.

Mark is the chief executive of a successful business he founded several years ago. He wants to provide for his family in the event of his premature death and is considering life cover of £1 million. He has a salary of £50,000 and an annual bonus of £25,000.

His company provides death in service benefits as part of its pension scheme for employees (4 x basic salary), so this is one possibility for Mark. It has the advantage that the company would pay the premiums rather than himself but his total sum assured would be restricted to £200,000.

However, he has already built up a pension fund of £700,000 and wants to continue funding it to the maximum amount available. Premiums paid for the death in service benefits would count towards his Annual Pension Allowance – currently £40,000.

More importantly, the death benefits would count towards the Lifetime Allowance, which is currently £1.03 million. Even with fixed protection to maintain his allowance at £1.03 million (2018/19), Mark would breach it in the event of a death claim, triggering a potential 55% tax charge.

An alternative would be for Mark to take out life assurance himself. In this case, it wouldn’t count towards his pension allowances, but he would have to pay the premiums himself, out of his taxed income.

An Alternative Solution.

A better option for Mark is for the company to take out a Relevant Life Plan (RLP) on his life. This is a term assurance plan that can provide the life cover he wants.

The Plan has two benefits:

• Although the company will pay the premiums, it isn’t part of the pension scheme, so won’t count towards either his Annual Allowance or Lifetime Allowance. This means he can continue to fund his pension to the maximum and, if a claim is made, his family won’t be faced with a hefty recovery charge.

• The plan is generally viewed by HMRC as an allowable business expense. This means that the premiums and any claim benefit should qualify for relief from income tax, National Insurance contributions and corporation tax.

Another major benefit is that the multiples are based on his total remuneration and are much more generous (up to 25x depending on age) meaning he could have cover as high as £1,875,000.

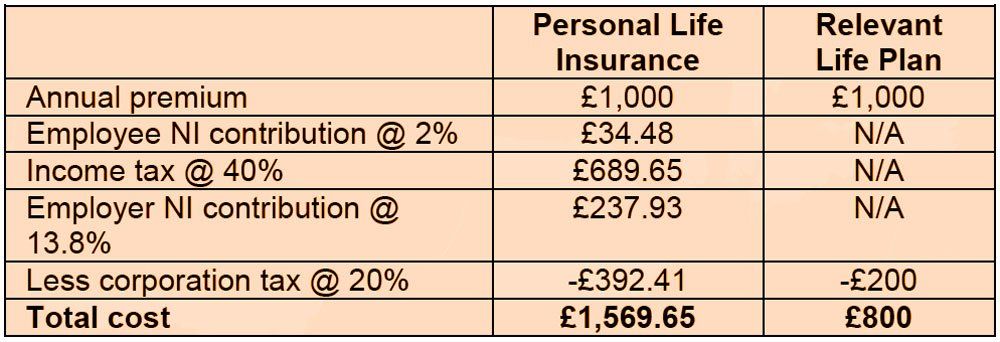

Based on an annual premium of £1,000, the table below illustrates the considerable saving of a RLP compared to personal life insurance. The company could save £769.95 which is a considerable saving (of almost 50%) which is great news for Mark who owns the company.

Mark can also benefit from additional features of the plan:

• Terminal illness cover that will pay out if life expectancy is less than 12 months;

• Continuation cover that means if he leaves the company he can convert the Relevant Life Plan to a personal plan or move it to a new employer without the need for further medical evidence or underwriting;

• The option to change the amount of cover and length of term, subject to underwriting and possibly higher premiums.

To search for a Trusted Xperts Partner Accountant, Financial Adviser or Law Firm in your area, simply visit the Trusted Xperts Partner Search page and zoom in to your area and click the pin of interest, or search for a Partner in the Search Box below and our powerful Search App will assist you.

Alternatively, if you prefer to speak with us in complete confidence, please Call us or use our secure enquiry form below, and Trusted Xperts Limited will get back in touch.

Please note - Trusted Xperts are not authorised to give advice. We will only confirm your details and enquiry purpose and with your consent, pass your Personal Information over to a selected Trusted Xperts Partner. Telephone calls may be recorded.